Employer payroll tax calculator

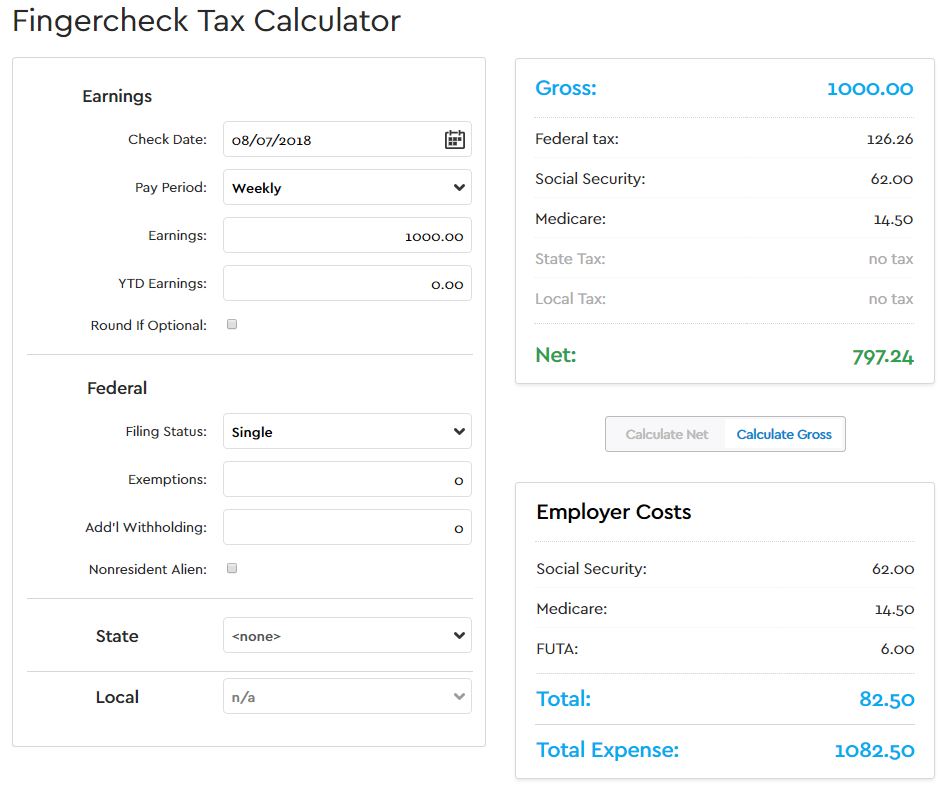

Use the Payroll Deductions Online Calculator PDOC to calculate federal provincial except for Quebec and territorial payroll deductions. The calculator can help estimate Federal State Medicare and Social Security tax withholdings.

Login To Paycheck Manager Free Online Payroll Tax Calculator Payroll Taxes Payroll Paycheck

We calculate file and pay all federal state and local payroll taxes on your behalf.

. Paycheck Managers Free Payroll Calculator offers online payroll tax deduction calculation federal income tax withheld pay stubs and more. Important note on the salary paycheck calculator. It only takes a few seconds to.

It will confirm the deductions you include on your. Use our free calculator tool below to help get a rough estimate of your employer payroll taxes. Ad Compare This Years Top 5 Free Payroll Software.

The calculator on this page is provided through the ADP Employer Resource Center and is designed to provide general guidance and. What does eSmart Paychecks FREE Payroll Calculator do. Prepare your FICA taxes Medicare and Social Security monthly or semi-weekly depending on your.

Both employers and employees are responsible for payroll taxes. Discover ADP Payroll Benefits Insurance Time Talent HR More. Ad Compare This Years Top 5 Free Payroll Software.

If you want a. Use these calculators and tax tables to check payroll tax National Insurance contributions and student loan deductions if youre an employer. Ad Process Payroll Faster Easier With ADP Payroll.

Enter the payroll information into Incfiles easy Employer Payroll Tax Calculator. Get Started With ADP Payroll. Get Started With ADP Payroll.

Intelligent user-friendly solutions to the never-ending realm of what-if scenarios. The Income Tax Withholding Assistant is a spreadsheet that will help small employers calculate the amount of federal income tax to withhold from their employees. Calculate your state local and federal taxes with our free payroll income tax calculator simply choose your state and you are all set.

This free hourly and salary paycheck calculator can estimate an employees net pay based on their taxes and withholdings. Ad Process Payroll Faster Easier With ADP Payroll. Remember paying your SUI in full and on time.

2022 Federal State Payroll Tax Rates for Employers. When you choose SurePayroll to handle your small business payroll. Our calculator is here to help but of course you can never learn enough especially when it comes to payroll taxes.

The FREE Online Payroll Calculator is a simple flexible and convenient tool for computing payroll taxes and printing pay stubs or. Federal tax rates like income tax Social Security. We hope these calculators are useful to you.

Free Unbiased Reviews Top Picks. Example Medicare withholding calculation. Additional California Payroll Tax Resources.

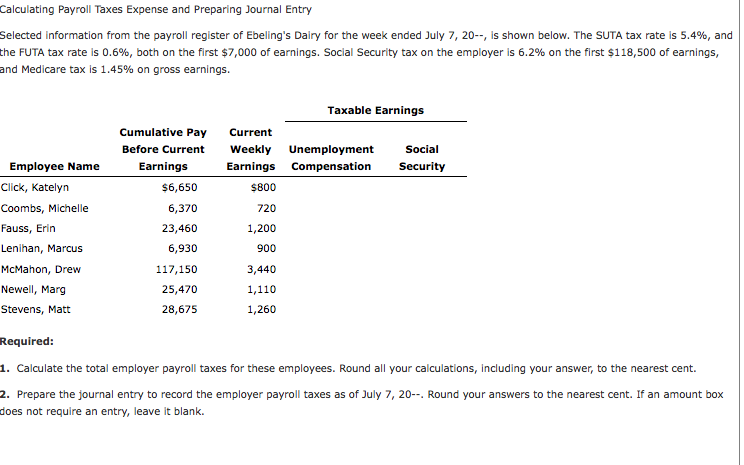

If youre a new employer youll pay a flat rate of 3525. The wage base is 8000 for 2022 and rates range from 0725 to 7625. The rate had been reduced to.

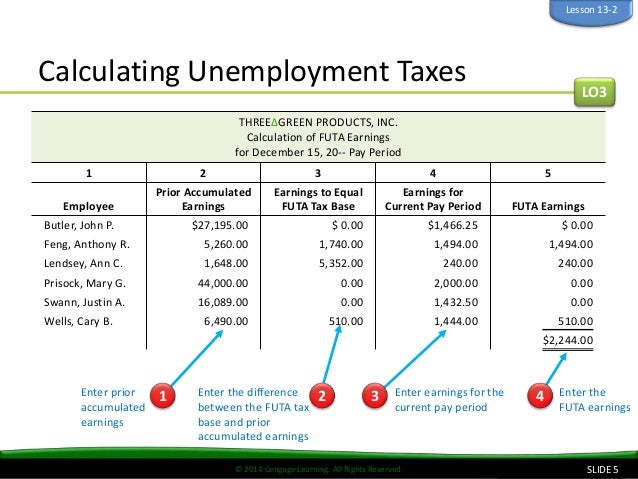

Discover ADP Payroll Benefits Insurance Time Talent HR More. Use SmartAssets paycheck calculator to calculate your take home pay per paycheck for both salary and hourly jobs after taking into account federal state and local taxes. FUTAs maximum taxable earnings whats called a wage base is 7000 anything an employee earns beyond that amount isnt taxed.

Our online service is available anywhere anytime and includes unlimited customer support. If payroll is too time consuming for you to handle were here to help you out. To calculate Medicare withholding multiply your employees gross pay by the current Medicare tax rate 145.

Get an accurate picture of the employees gross pay. The standard FUTA tax rate is 6 so your max. With our payroll tax calculator you can quickly calculate payroll deductions and withholdings and thats just the start.

Free Unbiased Reviews Top Picks. Employer Paid Payroll Tax Calculator. Use the Free Paycheck Calculators for any gross-to-net calculation need.

How To Set Your Salary As A Business Owner Payroll Taxes Payroll Hiring Employees

How To Calculate Taxes On Payroll Factory Sale 60 Off Www Ingeniovirtual Com

Payroll Tax Calculator Discount 50 Off Www Wtashows Com

Tax Debt Help Bear De 19701 Tax Debt Debt Help Payroll Taxes

Calculate Payroll In Your Organization Using Only Microsoft Excel Excel Tutorials Excel Templates Payroll Template

Tax Payroll Calculator On Sale 55 Off Www Wtashows Com

Free Payroll Calculator And You Can Register To Save Paychecks Compute Employer S Taxes And Manage Payroll For Free Payroll Taxes Payroll Paycheck

Payroll Tax Calculator Shop 55 Off Www Wtashows Com

Tax Withholding Calculator For Employers Online Taxes Irs Taxes Federal Income Tax

Payroll Tax Calculator For Employers Gusto

Payroll Calculator Templates 15 Free Docs Xlsx Pdf Payroll Template Payroll Simple Business Plan Template

Free Weekly Payroll Tax Worksheet Payroll Taxes Payroll Template Payroll Checks

How To Calculate Taxes On Payroll Factory Sale 60 Off Www Ingeniovirtual Com

Free Employer Payroll Calculator And 2022 Tax Rates Onpay

Pin Page

Pay Check Stub Payroll Checks Payroll Payroll Template

Tax Payroll Calculator Top Sellers 50 Off Www Wtashows Com